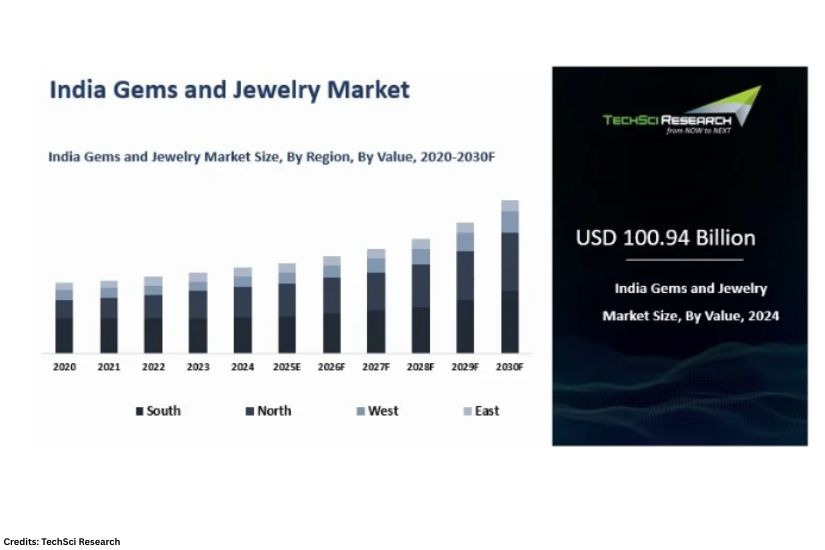

India’s gems and jewellery industry, deeply embedded in culture and commerce, is poised for exponential growth. According to TechSci Research, the market, valued at USD 100.94 billion in 2024, is projected to reach USD 168.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.9%.

A combination of tradition, modern lifestyle changes, rising disposable income, and the rapid adoption of digital retail drives this growth.

Cultural Significance Continues to Drive Demand

Jewellery remains an emotional and spiritual investment for Indian consumers. Weddings alone account for nearly 50% of total jewellery purchases, with festivals like Diwali, Dhanteras, and Akshaya Tritiya further fueling demand.

Gold continues to dominate the market, but modern buyers are expanding their preferences to include diamonds, gemstones, and lab-grown alternatives.

Key Growth Drivers Identified by TechSci Research

- Urbanisation & Income Growth

Rising disposable incomes, especially among urban millennials, are leading to increased spending on luxury and everyday-wear jewellery. - Shift Towards Branded & Lightweight Jewellery

Young consumers prefer 14K and 18K gold, minimalist diamond jewellery, and customizable pieces that fit daily lifestyle needs. - Digital Transformation

E-commerce is the fastest-growing jewellery sales channel in India, even though offline retail still holds a lion’s share. Online platforms offer convenience, transparency, and design variety that appeals to tech-savvy shoppers. - Lab-Grown Diamond Boom

The lab-grown diamond market, valued at USD 342.85 million in 2024, is expected to double and cross USD 706 million by 2030. It appeals to eco-conscious buyers due to its ethical sourcing, affordability, and customisation potential.

Regional Trends: South India Leads the Way

Southern states remain the biggest contributors to the Indian jewellery market, with cities like Chennai, Hyderabad, and Bengaluru showing strong demand for traditional gold as well as contemporary designer pieces. A strong brand presence and higher income levels in these regions give them a competitive edge.

Opportunities on the Horizon

- Export Growth: With trade agreements like CEPA and enhanced hallmarking rules, India is improving its global market share.

- Innovation in Design: Brands are experimenting with AI-powered customisation, AR try-ons, and sustainable jewellery practices.

- Rise of Men’s and Kids’ Jewellery: Untapped segments are expected to gain momentum in the coming years.

Industry Challenges

Despite the bullish forecast, the sector faces some roadblocks:

- Price volatility in gold, diamonds, and currency exchange

- High import duties and GST compliance pressure on small jewellers

- Stiff competition from imitation jewellery and Western fast-fashion jewellery brands

Key Players in the Indian Jewellery Market

According to the TechSci Research report, the Indian Gems & jewellery market is led by established players such as Rajesh Exports, Malabar Gold & Diamonds, Tanishq (Titan Company), Kalyan Jewellers, CaratLane, PC Jewellers, and others.

These brands are actively investing in digital strategies, retail expansion, and customer experience to maintain leadership.

Future Outlook: 2030 and Beyond

India’s jewellery sector is entering a golden decade. From lab-grown diamonds and tech-enabled jewellery retailing to expanding international exports, the industry is adapting to meet the needs of Gen Z, working professionals, and global buyers.

As consumer preferences evolve, personalisation, sustainability, and digital convenience will shape the future of jewellery in India.

TechSci Research’s latest findings reaffirm that India’s Gems & Jewellery Market is on a golden path of growth. For businesses, adapting to changing consumer behaviour, embracing technology, and exploring new market segments will be key to staying relevant and profitable.

Want the latest updates? Explore our News section